Array

(

[fid] => 6974

[description] => 专注于币圈最新最快资讯,数字货币应用及知识普及

[password] =>

[icon] => b1/common_6974_icon.png

[redirect] =>

[attachextensions] =>

[creditspolicy] => Array

(

[post] => Array

(

[usecustom] => 1

[cycletype] => 1

[cycletime] => 0

[rewardnum] => 5

[extcredits1] => 1

[extcredits2] => 1

[extcredits3] => 0

[extcredits4] => 0

[extcredits5] => 0

[extcredits6] => 0

[extcredits7] => 0

[extcredits8] => 0

[rid] => 1

[fid] => 6974

[rulename] => 发表主题

[action] => post

[fids] => 32,52,67,447,1120,1151,1156,6750,6762,6763,6766,6769,6772,6773,6787,6796,6808,6809,6810,6813,6814,6820,6829,6830,6846,6856,6864,6865,6827,6930,6931,6776,6858,6880,6764,6932,6871,6758,6905,1116,6788,6812,6798,6736,6759,6842,6966,6767,6828,6924,6935,6936,6938,6940,6941,6826,6909,6803,6919,6911,6908,6881,6920,6912,6913,6921,6925,6922,6789,6818,6819,6872,6928,6969,6889,6888,6917,6939,6947,6961,6937,6943,6970,6869,6900,6902,6783,6817,1111,6870,6821,6876,6952,6954,6960,6942,6910,6949,6962,6963,6964,6927,6926,6973,6728,6929,6874,6894,6896,6885,6857,6868,1113,6778,56,6844,6878,6802,6933,6811,6923,6877,6875,6918,6892,6757,6832,6833,6795,6793,6848,6837,6849,6850,6851,6852,6853,6854,6863,6882,6836,6790,6838,6794,6791,6873,555,6934,6958,6944,6945,6907,6779,6886,6950,6904,6956,6862,6957,6855,6955,6959,6914,6965,6971,6972,6953,6976,6824,6815,6891,6866,6979,6977,6765,6903,6948,6980,6981,6983,6799,6982,6951,6984,6975,6895,6845,6879,1121,6974

)

[reply] => Array

(

[usecustom] => 1

[cycletype] => 1

[cycletime] => 0

[rewardnum] => 0

[extcredits1] => 0

[extcredits2] => 1

[extcredits3] => 10

[extcredits4] => 0

[extcredits5] => 0

[extcredits6] => 0

[extcredits7] => 0

[extcredits8] => 0

[rid] => 2

[fid] => 6974

[rulename] => 发表回复

[action] => reply

[fids] => 32,52,67,447,1120,1151,1156,6750,6763,6766,6769,6772,6773,6787,6796,6808,6809,6810,6813,6814,6820,6829,6830,6846,6856,6864,6865,6827,6930,6931,6776,6858,6880,6764,6932,6871,6758,1116,6788,6812,6798,6736,6759,6842,6966,6767,6828,6924,6935,6936,6938,6940,6941,6826,6909,6803,6919,6911,6908,6881,6920,6912,6913,6921,6925,6922,6789,6818,6819,6872,6928,6969,6889,6888,6917,6939,6947,6961,6937,6943,6970,6869,6900,6902,6783,6817,1111,6870,6821,6876,6952,6954,6960,6942,6910,6949,6962,6963,6964,6927,6926,6973,6728,6929,6874,6894,6896,6885,6857,6868,1113,6778,56,6844,6878,6802,6933,6811,6923,6877,6875,6918,6892,6757,6832,6833,6795,6793,6848,6837,6849,6850,6851,6852,6853,6854,6863,6836,6790,6838,6794,6791,6873,555,6934,6958,6944,6945,6907,6779,6886,6950,6904,6956,6862,6957,6855,6955,6959,6914,6965,6971,6972,6953,6976,6824,6815,6891,6866,6979,6977,6765,6903,6948,6980,6981,6983,6799,6982,6951,6984,6975,6895,6845,6879,1121,6974

)

)

[formulaperm] => a:5:{i:0;s:0:"";i:1;s:0:"";s:7:"message";s:0:"";s:5:"medal";N;s:5:"users";s:0:"";}

[moderators] => 实习版主1

[rules] =>

[threadtypes] => Array

(

[required] => 1

[listable] => 1

[prefix] => 1

[types] => Array

(

[1590] => 论坛公告

[1752] => 公司优惠

[1603] => 虚拟币交流

[1753] => 数字钱包

[1754] => 虚拟币存提

[1755] => 交易所

[1655] => 虚拟币资讯

[1756] => 银行卡

[1757] => 第三方支付

[1760] => 币圈大佬

[1758] => 科技前沿

[1759] => 天策嗨聊

[1661] => 入驻合作

)

[icons] => Array

(

[1590] =>

[1752] =>

[1603] =>

[1753] =>

[1754] =>

[1755] =>

[1655] =>

[1756] =>

[1757] =>

[1760] =>

[1758] =>

[1759] =>

[1661] =>

)

[moderators] => Array

(

[1590] => 1

[1752] =>

[1603] =>

[1753] =>

[1754] =>

[1755] =>

[1655] =>

[1756] =>

[1757] =>

[1760] =>

[1758] =>

[1759] => 1

[1661] =>

)

)

[threadsorts] => Array

(

)

[viewperm] => 9 26 22 11 12 13 14 15 27 43 44 60 61 62 63 64 19 31 67 68 69 73 75 76 83 84 87 90 91 92 33 38 57 58 65 66 74 77 79 80 85 86 1 2 3 7 8

[postperm] => 22 11 12 13 14 15 27 43 44 60 61 62 63 64 19 67 68 69 73 75 76 83 84 87 90 91 92 33 38 57 58 65 66 74 77 79 80 85 86 1 2 3

[replyperm] => 26 22 11 12 13 14 15 27 43 44 60 61 62 63 64 19 67 68 69 73 75 76 83 84 87 90 91 92 33 38 57 58 65 66 74 77 79 80 85 86 1 2 3

[getattachperm] => 26 22 11 12 13 14 15 27 43 44 60 61 62 63 64 19 67 68 69 73 75 76 83 84 87 90 91 92 33 38 57 58 65 66 74 77 79 80 85 86 1 2 3

[postattachperm] => 26 22 11 12 13 14 15 27 43 44 60 61 62 63 64 19 67 68 69 73 75 76 83 84 87 90 91 92 33 38 57 58 65 66 74 77 79 80 85 86 1 2 3

[postimageperm] => 26 22 11 12 13 14 15 27 43 44 60 61 62 63 64 19 67 68 69 73 75 76 83 84 87 90 91 92 33 38 57 58 65 66 74 77 79 80 85 86 1 2 3

[spviewperm] =>

[seotitle] =>

[keywords] =>

[seodescription] =>

[supe_pushsetting] =>

[modrecommend] => Array

(

[open] => 0

[num] => 10

[imagenum] => 0

[imagewidth] => 300

[imageheight] => 250

[maxlength] => 0

[cachelife] => 0

[dateline] => 0

)

[threadplugin] => Array

(

)

[replybg] =>

[extra] => a:2:{s:9:"namecolor";s:0:"";s:9:"iconwidth";s:2:"60";}

[jointype] => 0

[gviewperm] => 0

[membernum] => 0

[dateline] => 0

[lastupdate] => 0

[activity] => 0

[founderuid] => 0

[foundername] =>

[banner] =>

[groupnum] => 0

[commentitem] =>

[relatedgroup] =>

[picstyle] => 0

[widthauto] => 0

[noantitheft] => 0

[noforumhidewater] => 0

[noforumrecommend] => 0

[livetid] => 0

[price] => 0

[fup] => 6729

[type] => forum

[name] => 虚拟币讨论大厅

[status] => 1

[displayorder] => 3

[styleid] => 0

[threads] => 29091

[posts] => 474826

[todayposts] => 4

[yesterdayposts] => 87

[rank] => 2

[oldrank] => 2

[lastpost] => 2787930 Circle 赢得 ADGM 牌照,并任命前 Visa 高管领导中东拓展业务(转) 1766278506 22301

[domain] =>

[allowsmilies] => 1

[allowhtml] => 1

[allowbbcode] => 1

[allowimgcode] => 1

[allowmediacode] => 0

[allowanonymous] => 0

[allowpostspecial] => 21

[allowspecialonly] => 0

[allowappend] => 0

[alloweditrules] => 1

[allowfeed] => 0

[allowside] => 0

[recyclebin] => 1

[modnewposts] => 2

[jammer] => 1

[disablewatermark] => 0

[inheritedmod] => 0

[autoclose] => 0

[forumcolumns] => 3

[catforumcolumns] => 0

[threadcaches] => 0

[alloweditpost] => 1

[simple] => 16

[modworks] => 1

[allowglobalstick] => 1

[level] => 0

[commoncredits] => 0

[archive] => 0

[recommend] => 0

[favtimes] => 0

[sharetimes] => 0

[disablethumb] => 0

[disablecollect] => 0

[ismoderator] => 0

[threadtableid] => 0

[allowreply] =>

[allowpost] =>

[allowpostattach] =>

)

当前离线

经验:

天策币:

活跃币:

策小分:

总在线: 分钟

本月在线: 分钟

|

|

|

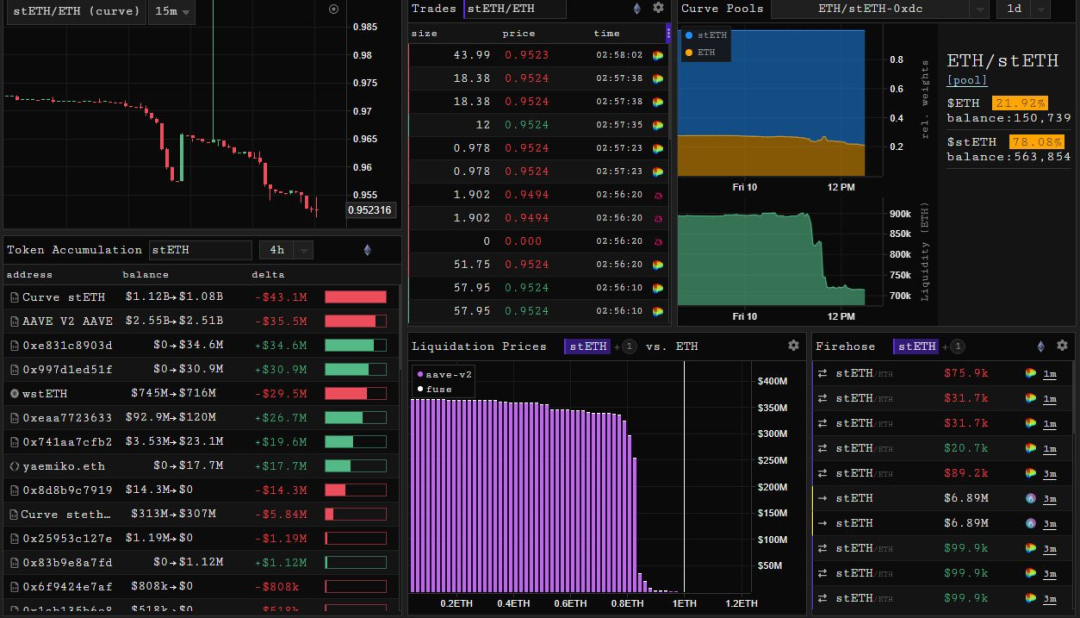

熊市会放大任何一个可能的利空,这次轮到stETH。

! |+ c2 }$ t9 c2 [( X1 h+ P从上周五开始,市场上关于stETH脱钩清算的恐慌情绪持续蔓延,这其中很大一部分源于对stETH的不了解。对此,本文整理出关于stETH的8个常识,以降低大量误解带来的不必要影响。 - F" P c5 }% F4 u: X! v% r

01

) M7 ^+ C y$ _: P0 {, xstETH不会是下一个UST 8 Q* _. u& m: Y: E: }0 p

stETH是质押在以太坊信标链上的ETH,且完全由信标链上的ETH1:1支持,即1枚stETH=1枚质押中的ETH。

+ Q/ _& y0 G' {当以太坊合并完成,且信标链开放提现功能时,用户持有1枚stETH可以兑换1枚ETH,因此任何将它与UST等抵押不足的稳定币的比较都是错误的。 3 L! }: X8 J7 V- [1 M0 v

02

/ C5 I9 O9 i: _5 sstETH不是GBTC

6 P0 H7 L2 T" A: U0 H' j. ?stETH是一种ERC20代币,在不断发展的DeFi生态系统中有很高的实用性。 ! S: d9 \/ G! v5 F1 m5 ~% b" {! Z% Z. ~

它自带一个原生的收益率,这是你单独持有ETH所不能获取的。市场里有很多人都愿意为此承担套利风险。 5 B; K- `$ X% a m; T

03 3 h& F* U- B4 G0 l$ F

stETH价格不一定与ETH挂钩

+ }+ N! `8 {. v. c8 A! nstETH与ETH并没有一个固定的挂钩率,无论二级市场的估值如何,它都会继续被质押。 ; S; s2 z' O8 i: x

现在能在二级市场上将stETH换成ETH只是为了方便,但同时你也会得到市场对它的估价。 |. l4 n0 Z7 t+ J% u$ }

04 6 k" Y; q/ w; Y3 g' P* N3 @% ?* g

stETH存在套利机会 % u) z2 p0 X9 E, u- |# R3 R

一般来说,只要存款没有上限,stETH就不会以高于1ETH的价格交易。 ) p+ L }% }/ V

因为其中存在套利:

6 m3 E7 k5 x$ Q! ?* E& n如果1stETH=1.05ETH,那么我可以将1ETH存入Lido,得到1stETH,在二级市场以1.05ETH的价格出售,获利0.05ETH,这种方式也会推低stETH的价格。

! T; @# d+ c( a) w& M当stETH的赎回开放后,市场有一个奏效的套利方式: + H: N) }1 N* T" f* K

如果stETH以0.95ETH交易,那么我可以用0.95ETH买入1stETH,然后将其赎回1ETH,获得0.05ETH的利润,这种方式会推高stETH的价格。 v7 I9 g2 \* e' a7 I

05 4 J& m5 K' A6 v& l* f& m

即使合并,赎回仍要等6-12个月

" \& }1 [6 B4 O, m A需要注意的是,以太坊合并之后,需要等待状态转换的分叉,这可能需要6-12个月,此时的stETH仍然无法从信标链中赎回ETH。赎回开放后,信标链上还有一个赎回队列,一次可以取消质押的ETH数量是有限制的。 3 [: \# [* v) k. W% I5 z

06

7 Z% R" t3 h3 m$ k+ t! W* x影响stETH价格的四大因素

# A w9 a2 a. ~有多种原因使stETH暂时高于/低于其抵押品价值,其中包括但不限于: . D @9 V3 }7 E. h9 Q) X

流动性溢价风险 Lido协议风险 信标链推迟风险 杠杆玩家清算风险

X# t* x& N! [

07 ! }1 K: o& t0 H* N4 e$ ]% `

引发stETH清算的原因

0 @: v& L/ S0 W4 @! J杠杆清算风险是当前引发恐慌的最大原因。 , o% y5 b) w9 w

前面提过,stETH是一个ERC20代币,可以在DeFi生态系统中用作抵押品,人们将stETH作为抵押品存入Aave,借入ETH,存入Lido以获取stETH,然后再重复这一过程。 ! U( g8 c( d, K+ K5 ^4 ~" ^

因此,如果人们继续在二级市场上卖出stETH,这些杠杆头寸可能会被清算,从而导致更大的清算级联。目前较大的做市商/操纵者已经退出,但仍有一些留在这里。 + c, i6 Y L3 S( h& S6 n# P

3 }7 r* D, j4 f2 ]/ @& Z* i# `Celsius可能会也可能不会遇到流动性问题,但他们持有大量的stETH被用作借入稳定币的抵押品。如果出售,这肯定会导致stETH的二级市场价格下降。

! e$ B1 P( s% n所有这一切的另一面是,无论二级市场如何评价stETH,stETH仍然被信标链上的ETH以1:1的比例支持。

. b: y# N7 T2 D. S/ ]: M+ J根据您的时间偏好和风险承受能力,在低价时入手stETH会提高一定的收益水平。 ' s/ W+ U$ l( x7 V1 }

例如,如果1stETH的交易价格为0.70ETH(也就是30%的折扣),并且以太坊抵押收益率保持4%的APR。在以太坊成功合并且开放赎回功能的这两年里,你将获得38%的APR,而不是普通质押者8%的收益率(以太坊质押不会自动产生复利)。

4 ?* @2 U8 a' F' `08

4 E5 q! p6 F3 e3-5%的负溢价是正常的 $ h6 }* ^# ~+ R* }7 ^ M4 E5 |. V

那么,是否值得为了收益率而去冒Lido漏洞和流动性不足的风险? ' o1 n/ ~2 m9 x2 O7 M

不是每个人都能接受,但某些套利者一定会做。虽然清算级联很惨,stETH的二级市场价格暂时不会是1:1ETH,但这并不会导致死亡螺旋。

+ N( K: H3 \! t' E5 G: b# B" W我认为,等这波恐慌过去后,stETH可能仍会以低于抵押品价值的价格交易,可能是3-5%的负溢价,这在很大程度上取决于市场情绪。但无论如何,信标链将继续,DeFi会继续,Lido也会继续。

& x1 q6 Q0 @ y/ B7 h/ `+ `3 A( ?来源:金色财经 |

|

|

|

|

|

|

|

|

|